As digital technology revolutionized all the major industries and market sectors, the domain of online payment and digital currency underwent several sea changes as well. One of the most intriguing topics in this field is that of cryptocurrency, which became extremely popular with the invention of bitcoin.

While the technology that’s responsible for the functionality of the bitcoin is relatively complicated, this article breaks down another confusing aspect of cryptocurrencies: taxation.

What is cryptocurrency?

Cryptocurrency is also a form of digital currency but is unique because of the encryption technology that makes it impossible to counterfeit or spend illegally.

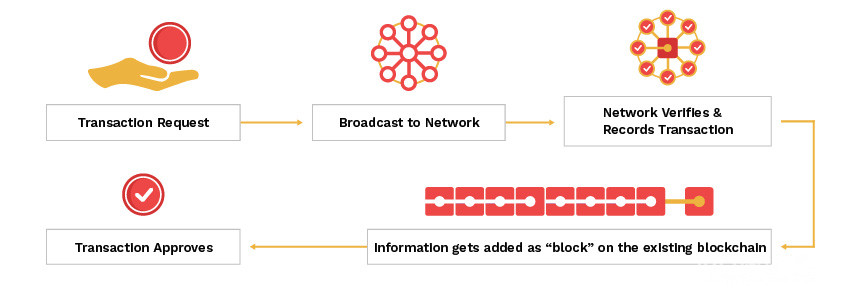

Cryptocurrencies are decentralized, meaning that any bank or government does not issue them, but they are organized using blockchain technology, which is a digital ledger of sorts, keeping track of every bitcoin or crypto transaction ever made.

Usage of cryptocurrencies

Since this is also a form of digital payment, cryptocurrencies are accepted in several places as a method of payment, even though it is technically not legal tender.

Moreover, investors consider cryptocurrencies as assets they can invest and trade-in, and there are crypto exchanges that provide a platform for such traders to make deals. Naturally, many governments tried to bring regulations on such a significant asset, including taxation.

Taxes on cryptocurrencies

The Internal Revenue Service in the US and a lot of its counterparts in other countries have agreed to treat bitcoin and other cryptocurrencies as assets rather than as a currency.

So, cryptocurrencies were no longer the same because all the users had to report earnings, losses, purchases, and every transaction they ever made with crypto.

What transactions are taxable?

- Selling bitcoins that you generated (or mined) to a third party

- Selling bitcoins that you bought from someone to a third party

- Using bitcoins that you mined to purchase goods or services

- Using bitcoins bought from someone to buy products or services

Any transaction of the first or third type is taxed as personal or business income, after deducting expenses spent for the mining process. Any transaction of type 2 or type 4 is investments and hence, will be considered for capital gains tax.

If cryptocurrencies are held less than a year before they are exchanged or sold, the short-term capital gains tax is applied, equal to the ordinary income tax rate. If they are held for over a year, long-term capital gains tax is applied, with different tax brackets based on income range and marital status (different for married couples filing jointly or individually, widows and widowers, etc.).

What transactions are not taxed?

A few exceptions exist, such as:

- Transferring cryptocurrency as a gift below the gift tax exemption limit or donating to legitimate charities

- Transferring currencies between wallets or between exchanges

- Buying cryptocurrencies (you don’t have to pay taxes till you trade)

When donating to charities, they ensure that the received cryptocurrency is immediately sold on an exchange, and the dollar amount received can be invested as per the donor’s choice.

Filing Crypto Taxes

A few pointers on how to file crypto taxes effectively are given below:

1. Record-keeping is your duty

Cryptocurrencies are traded on plenty of exchanges and platforms, but none of them is obligated to maintain records of your transactions. If you employ brokers or other intermediaries to carry out crypto trades, they are not responsible either.

Although some platforms do report all transactions within that platform alone, ultimately, it is your responsibility to keep track of all your transactions of all types.

2. The dollar value of the cryptocurrency

Another critical factor in keeping records is the time stamp of each transaction because the underlying price of bitcoin or any other currency also keeps varying with time. Your tax will be computed based on the dollar value of the cryptocurrency at the time of each transaction.

For example, if you mined or got bitcoins worth $1000 five years ago, and now they are worth $5000, your net income is $4000 and not $5000, and this must be appropriately reported. Similarly, if you use bitcoins to buy a book, you will be taxed based on the cost of the book, the dollar value of the bitcoin at the time you got it, and at the time of purchase of the book.

3. Forks

Simply put, a fork is an upgrade in the blockchain either to add a new feature or to reset the blockchain history because of a bug, etc. A split of a blockchain creating two new blockchains and, in essence, a new cryptocurrency is a hard fork. Holders of the old currency will get an equal amount of the new currency at the time of the fork.

In 2019, the IRS gave new guidelines regarding forks, stating that new currencies must be treated as “an ordinary income equal to the fair market value of the new cryptocurrency when it is received.” It also said that if the holder got no new cryptocurrency, he had no taxable income.

4. Reporting bitcoin income

The actual paperwork varies from country to country, and you must find out the required forms to fill when filing crypto taxes in your country (it is worth mentioning that in several countries, trading in cryptocurrency is banned, like Nepal).

In the US, for example, income from cryptocurrencies have to be reported in Schedule D, an attachment of the Individual Income Tax Return Form 1040. Personal income and capital gains are detailed separately in the form.

In India, the ban on the trade of cryptocurrency was lifted in March 2020, but rules and guidelines are still minimal. Here, mining bitcoins is not a taxable activity. Long-term gains are taxed at a fixed rate of 20%, while short-term gains have separate tax slabs (when cryptocurrency is used as an investment).

It’s your turn to File Crypto Taxes

By now, you would have a clear idea about the theory behind calculating crypto taxes and a few other subtleties. To calculate the tax for the cryptocurrencies you own, there are many online software applications and bitcoin tax calculators free to use that help you file and calculate taxes.